If Covid-19 has hurt your finances, you’ll want to look into options that can help you manage your personal finances again. Here are some tips: Stick to a strict budget.Read more

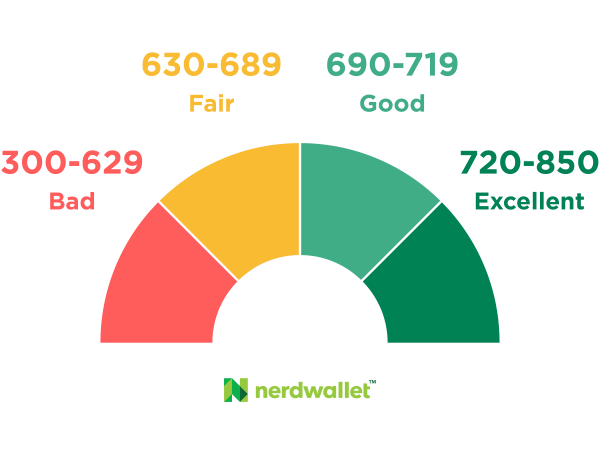

Credit Scores

For those who use Experian Boost, a service that allows you to count paid utility and phone bills toward improving your credit score,Read more

All small business owners need to take things like credit reports very seriously, otherwise they can find themselves in hot water. This especially applies when you’re looking into working with a new customer. If you’re using Experian, you can just sign up for a free account and provide the name and email address of theRead more

For anyone who is trying to improve your personal finances, here are a few ways to do so: Put money into a savings. Create a retirement fund and always put into it. Invest in stocks and bonds. Pay off outstanding debts. Stick to your budget.Read more

For those that want to check their credit report for free, you can do so with the following: Visit: annualcreditreport.com Call: 1-877-322-8228 Mail a form to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281Read more

Those with little to no credit history or between 500 and 600 on their FICO score may see an increase in loan opportunities. UltraFICO, a new type of credit score system, will help consumers establish a credit score based on their banking and savings habits rather than credit cards, loans and debts. It’s meant toRead more

Planning on popping the question? Well there are certain ways that your credit score might play a factor in that decision. Spray out payments if it’s not possible to make the purchase in one fell swoop. Use the credit card rewards to plan a honeymoon. Another great perk of rewards is finding cards that haveRead more

If you’ve been in a car accident, you might be wondering how it could affect your credit score. Car accidents can cost up to $44 billion in medical care and lost work, but that doesn’t include property damage, injuries, and other more permanent side effects. While car accidents don’t directly affect your credit score sinceRead more

The first step in improving your credit is understanding it. Begin by checking your online scores, and then you will see which factors are affecting your scores the most. That information will lead you to a plan of action, by making the changes and improvements specific to your situation. Generally speaking, payment history and utilization ratioRead more

It is important to manage your credit card bills at all times, good and bad. If you see that you re struggling with making payments, contact your lender to see what you can do and how they can help. Ignoring the problem will not make it go away and things can only get worse fromRead more